Why is Zillow Not Showing a Zestimate

The Mystery of Missing Zestimates: Understanding Zillow’s Algorithm

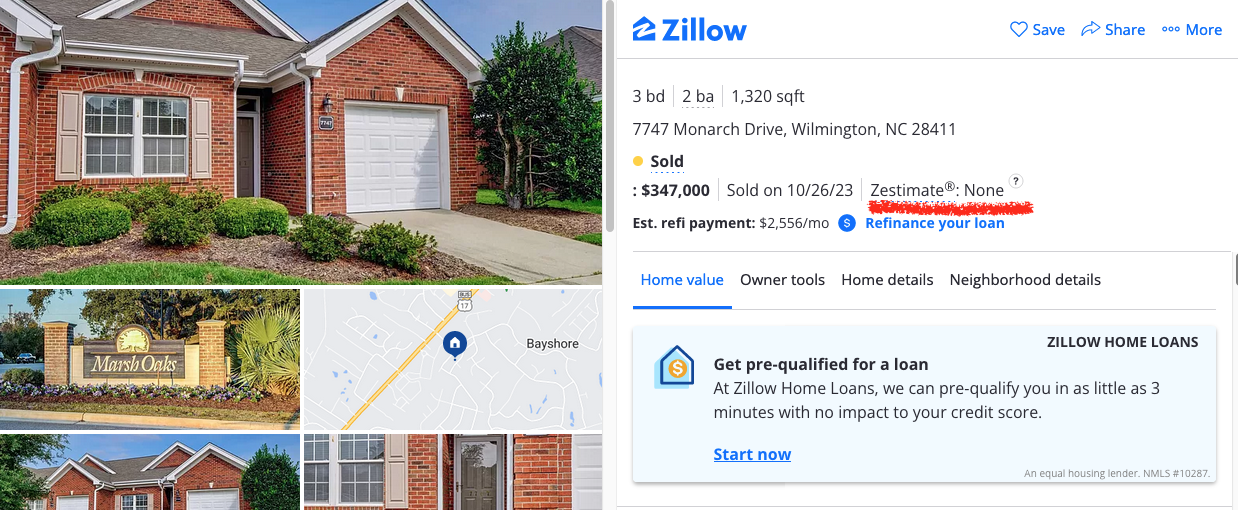

Zillow has become a household name, and often the first word that comes to mind when talking “real estate.” Zillow’s user-friendly interface, extensive listings, and the intriguing “Zestimate” feature have made it a go-to platform for homebuyers, sellers, and curious onlookers alike. However, there are times when Zillow doesn’t display a Zestimate for a particular property, which is confusing for users. There are a number of reasons behind why there are missing Zestimates, many of which hinge on the intricacies of Zillow’s algorithm.

The Zestimate: A Snapshot of Market Value

The Zestimate is Zillow’s proprietary home valuation algorithm, designed to provide an estimate of a property’s market value. It takes into account various factors such as location, square footage, number of bedrooms and bathrooms, recent sales data, and more. However, the algorithm’s intricacies and specific data sources are closely guarded secrets, which makes it difficult to verify the accuracy of property valuations.

One of the primary reasons a Zestimate might not be displayed is the availability and accuracy of data. If Zillow lacks sufficient, reliable data for a particular property, it may choose not to provide a Zestimate to avoid potential inaccuracies.

Unpredictable Variables in the Equation

The Zestimate algorithm heavily relies on recent sales data of similar properties – comparable sales – in the vicinity. If there are limited or no recent sales in the area, especially of homes with similar characteristics, Zillow might fail to generate a Zestimate.

Properties that are unique of non-standard deviate significantly from the norm, whether in terms of design, size, or location, can pose a challenge for Zillow’s algorithm. These unique properties may not have enough comparable data points for the algorithm to generate an accurate estimate. Providing a property value is many times a subjective exercise, and the Zestimate algorithm cannot work in a setting that demands more than hard data.

Local Market Dynamics and Seasonal Fluctuations

Real estate markets are dynamic and can experience rapid shifts due to various factors like economic conditions, development projects, or changes in neighborhood desirability. In such cases where markets are rapidly changing, Zillow may choose not to display a Zestimate to avoid potential misrepresentation.

Real estate markets can also be influenced by seasonal trends. For example, certain areas may experience a surge in activity during the spring and summer months. If a property lacks sufficient recent sales data during off-peak seasons, Zillow may withhold the Zestimate.

User-Generated Data and Feedback

Zillow allows users to update and edit information about properties. In cases where user-provided data conflicts with Zillow’s existing database, the platform may opt to withhold the Zestimate until the discrepancy is resolved.

Zillow constantly fine-tunes its algorithm to improve accuracy. This means that a property that previously had a Zestimate might temporarily lose it as the algorithm undergoes updates and refinements.

Conclusion

While the absence of a Zestimate on Zillow can be perplexing, it is important to recognize that the platform’s commitment to accuracy and reliability drives this decision. Factors such as data availability, unique property attributes, and market dynamics all play a role in whether or not a Zestimate is displayed.

By understanding these variables, users can navigate the platform more effectively. Consulting with an experienced local real estate agent empowers users to make more informed decisions in the complex world of real estate.